If you need a go-to solution for your small business accounting, QuickBooks will do the trick. Both versions offer automatic syncing with your bank so you can categorize transactions. Add payroll to QuickBooks Online starting at $45 per month, or to Desktop starting at $50, plus $2 per employee, per month.

- Terms, conditions, pricing, special features, and service and support options subject to change without notice.

- Features include mileage tracking, basic reporting, income and expense tracking, capture and organize receipts and estimation of quarterly taxes.

- Moving up to the Essentials Plan, you’ll pay $30 per month for the first three months, then $60 per month.

- QBO also has far more integrations with other business apps and software.

Whether you run an accounting firm or a small to medium-sized business, OneSpace securely hosts all your accounting, tax and business apps—so you can work confidently from anywhere. After a hosting provider dedicates a server with QuickBooks installed, you can access the hosted application by opening Remote Desktop Connection on your system. QuickBooks Online syncs with more than 750 different third-party business apps, ranging from point-of-sale apps to payment acceptance tools and beyond. Naturally, QuickBooks Online syncs with other QuickBooks products as well, including QuickBooks Time (formerly TimeTrex), TurboTax and QuickBooks Online Payroll. QuickBooks Payroll starts at $45 a month plus $6 per employee paid per month, and new users can choose between a an example of a bookkeeping entry of buying on credit 30-day free trial or 50% off discount just as they can with QuickBooks Online.

Over 2.3 million Desktop customers have made the switch to QuickBooks Online.1

But if you can afford QuickBooks’ cost, its excellent features will help you keep your finances in line as you grow from startup to fully fledged enterprise. On the other hand, QuickBooks is easier to learn, has strong mobile apps, and has tax support. The mobile apps what do cash flow statements have to do with liquidity chron com rank highly with Android users (3.9/5 stars) and iOS users (4.7/5 stars).

When comparing it to other bookkeeping providers, such as FreshBooks and Xero, we note that all three have a 30-day free trial to test the system out. This is important to note since you’ll want to make sure that it is capable of doing what you need in a manner that you understand and can digest. With qualifying for a mortgage with child support arrears single access, desktop-based accounting programs, you end up spending a lot of time compiling and creating financial reports for your accountant to review. Imagine that you’re waiting for a meeting with a potential client when you remember that you need to send an invoice to a different customer. But, this is just one of many hypothetical anecdotes that illustrates the importance of moving to a cloud accounting software solution—sooner rather than later.

Inventory management

Merchant Maverick’s ratings are not influenced by affiliate partnerships. When rating accounting and invoicing software, we use a 47-point rubric that looks at pricing, ease of use, features, customer service, and user reviews. We weigh each section differently to calculate the total star rating. One thing that FreshBooks has that QBO lacks is excellent customer support. It may also be a more affordable option provided you don’t have many users, as FreshBooks charges an additional fee per user. QBO has everything you’d expect from accounting or bookkeeping software, including expense tracking, bank reconciliation, journal entries, class tracking, and more.

QuickBooks hosting offers several benefits, including enhanced accessibility, automatic backups, multi-user collaboration, and scalability. It allows you to work from anywhere, ensures data security, and eliminates the need for on-premises server maintenance. QuickBooks hosting providers operate advanced data centers with powerful servers optimized for top-notch user experience. Equipped with robust hardware and backup systems, these servers ensure data integrity and availability.

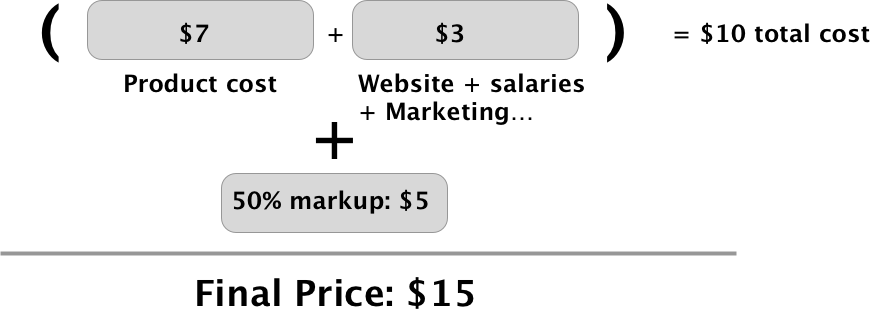

We also ensure that the software offers most standard accounting features and reports, awarding higher rankings to those that provide advanced services, like tax filing. QuickBooks Desktop is more traditional accounting software that you download and install on your computer, while QuickBooks Online is cloud-based accounting software you access through the internet. For the Desktop version, you pay an annual fee starting at $1,922 per year, and the cloud-based option starts at $15 per month. Both versions have mobile apps, but the app for the Desktop version primarily functions as a way to upload receipts, and the Online mobile app is robust in comparison. Intuit QuickBooks Online’s powerful, cloud-based accounting solution helps businesses of all sizes manage their finances. It’s one of the highest-rated and most popular bookkeeping software services — and for good reason.

Tax Support

While QuickBooks’ inventory management software isn’t the most advanced inventory option out there, it’s perfectly functional. Plus, Quickbooks’ thorough integration library ensures users can find inventory tracking software that both meets their needs and integrates with their accounting software. QuickBooks offers more — and better — reports than nearly any other accounting software provider.

Its well-organized dashboard includes a client portal business owners can use to collaborate with their customers on generating quotes, approving estimates, creating invoices and accepting payments. QuickBooks Online Advanced is more than double the cost of QuickBooks Online Plus, which can make it an expensive jump for midsize businesses seeking to scale up. Still, the plan is extremely comprehensive and includes employee expense tracking, batch invoicing and 25 users. Advanced is the only QuickBooks plan to include free 24/7 customer service.

Leave a reply